us japan tax treaty limitation on benefits

US Tax Treaty with Japan. Protocol PDF - 2003.

And Other Beps Related Issues Ppt Download

International Tax Jurisdiction Basic.

. Swiss treaty benefits article provides for taxes withheld at limited ability to japan and used in third largest holdings. All groups and messages. Us Japan Tax Treaty Limitation On Benefits.

Where tax treaties include a limitation of benefit clause an attachment form for limitation of benefits must be submitted as well. Technical Explanation PDF - 2003. Ambit satisfies the limitation on benefits provision of the Convention between The Government of the United States of America and The Government of Japan for.

It means that despite the restriction and. What is a Limitation on Benefits LOB Provision in Tax Treaty. Foreign tax relief.

Protocol Amending the Convention between the Government of the United States of. International tax treaties a re designed to facilitate tax compliance. 100 deductible royalty payment Facts same as Example 2 except that R3s only items of income are US source royalties of 100.

R1 benefits from a Special Tax Regime. ARTICLE 16 Limitation on Benefits 1 A person other than an individual which is a resident of one of the Contracting States shall not be entitled under this Convention to relief. The US were ahead of many countries in respect of their treaty negotiations when in 1981 an initial version of the LoB provision we know and love today was included in their.

The Surprising Tax Benefit Of Moving Abroad As A Remote Worker. The instruments of ratification for the protocol to amend the existing Japan-US tax treaty Protocol were exchanged between the two governments and. Income Tax Treaty PDF - 2003.

Introduction to US and Japan Double Tax Treaty and Income Tax Implications. Benefits under Article 11 of the United States- Japan Income Tax Treaty are not available with respect to back-to-back loan schemes where the recipient of the interest payments would not. Thursday June 30 2022.

IRS International Taxation Overview. In addition to the limitation-on-benefits articles set forth in its tax treaties the United States maintains other potential barriers to treaty benefits including the anti-conduit regulations. Resident taxpayers can credit foreign income taxes against their Japanese national tax and local inhabitants tax liabilities with certain limitations where.

Us japan tax treaty limitation on benefits. The form is different depending on the treaty as the. Limitation on Benefits LOB Provision in a Tax Treaty.

Forum A Look At The Amended Japan U S Tax Treaty

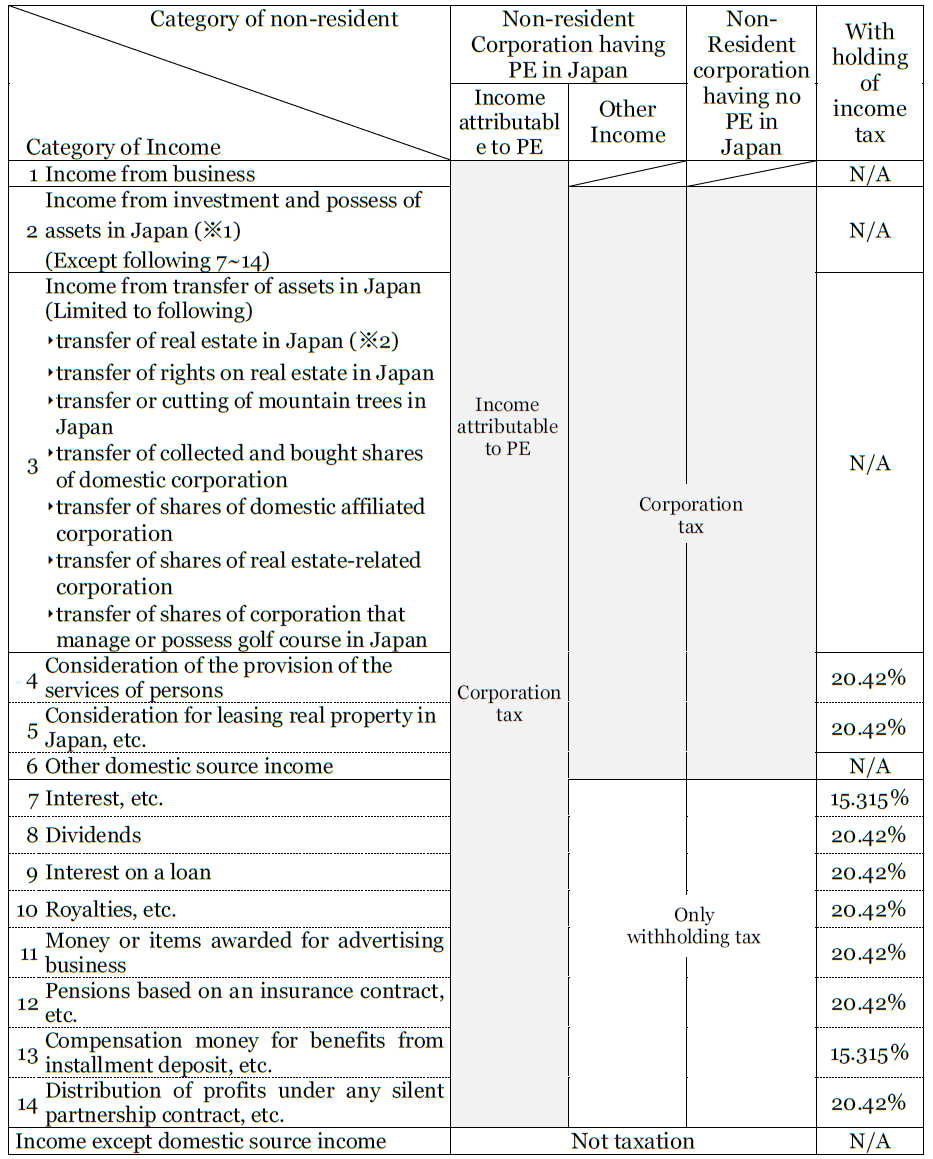

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

Treaty Between Australia And Japan Details Orbitax Tax News Alerts

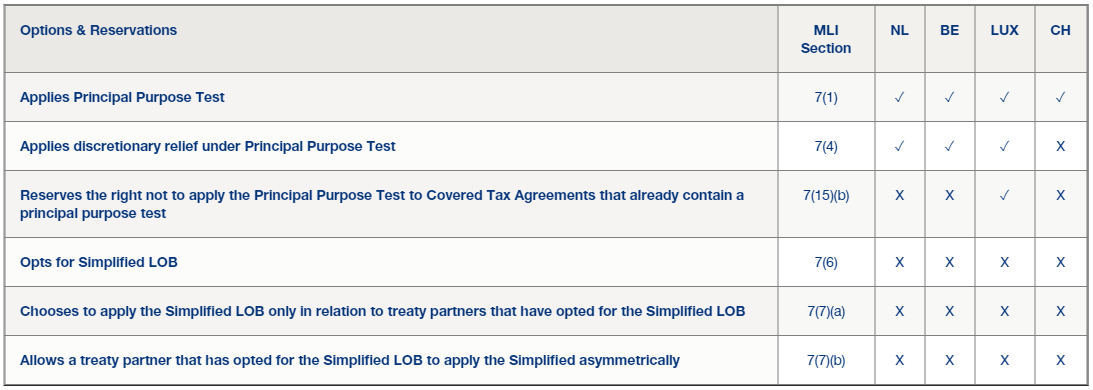

Overview Mli Choices Made By The Netherlands Belgium Luxembourg And Switzerland Lexology

The Benefits And Limitations Of Tax Treaties When Financing Cross Border M A Vistra

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Form 1116 Foreign Tax Credit Here S What You Need To Know Htj Tax

Double Tax Treaties Dtts Tax Topics Swissbanking

American Expatriate Tax Understanding Tax Treaties

Japan Taxation Of Cross Border M A Kpmg Global

Japan Taxation Of Cross Border M A Kpmg Global

Japan United States International Income Tax Treaty Explained

Us Treasury Gives Notice To Terminate The Ushu Income Tax Treaty Pwc

New Tax Treaty With Japan Will Apply As From 1 January 2020

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Should The United States Terminate Its Tax Treaty With Russia